The investment firm has acquired a 460 Unit multifamily community in the Houston MSA.

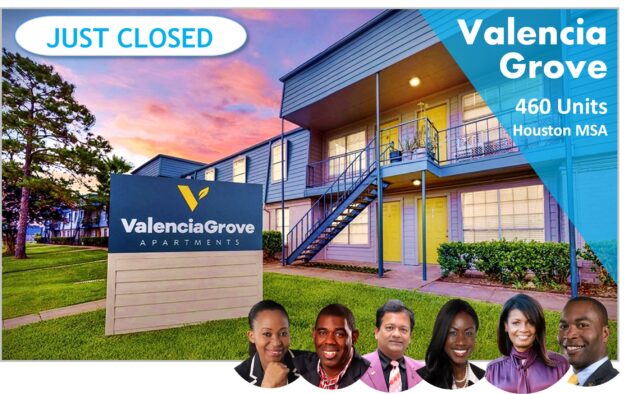

Bodka Creek Capital has acquired Valencia Grove Apartments, a 460-Unit Multifamily Complex in Houston, Texas.

Valencia Grove Apartments was the third acquisition for Bodka in 2021, following the close of two complexes in 1H 2021. The investment establishes Bodka Creek as the largest African-American, woman-owned real estate private equity firm in the United States. Located at 11810 Algonquin Drive, the property features a sparkling swimming pool, resident clubhouse, two dog parks, mature oak trees, spacious courtyards, and three onsite laundry facilities. Valencia is situated between Houston Hobby Airport and the NASA Mission Control Center and neighbors Memorial Hermann Southeast Hospital and San Jacinto College South Campus.

The firm plans to execute a value-add strategy that will drive occupancy and net operating income up, thus increasing the value of the property. Bodka Creek Capital is dedicated to revitalizing the exterior, interior, and amenities of the property to better serve current and future residents. Some of these improvements will include the addition of a new playground and walking trail, updating the resort style pool area, enhancing the property building systems, and renovating unit interiors.

“Valencia Grove exemplifies our multifamily value-add acquisition strategy and our emphasis on utilizing investment as a tool to build and improve communities,” Allyson Pritchett, Founder & CEO at Bodka Creek Capital, said in a news release. “Our past investments showcase our focus on the transformation of properties into high quality / budget friendly housing while building strong communities, a product which is increasingly in short supply. With the Southeast seeing such tremendous growth, we feel investments like these will be ever more important for the region into the future.”

Investment Partners included RTC Global Investments, Value Investment Partners, Trinity Investors, Impex Capital Group and Melifera Partners.

Vernon Beckford and Eric Andrew of Diversified Lending Solutions and Dwight Mortgage Trust’s New York Office secured the debt financing.

About Bodka Creek Capital

Bodka Creek Capital, LLC (http://www.bodkacreekcapital.com) is a privately held real estate private equity firm, engaged in the acquisition and active management of commercial property. The Houston-based company focuses on value-add and ground up development strategies in the multifamily, mixed-use, and self-storage sectors. Bodka Creek Capital currently manages a $100 million commercial real estate portfolio with almost 1000 multifamily units totaling more than 1,000,000-square feet of commercial space. The firm will continue to pursue value-add opportunities across the Southeast.

SOURCE Bodka Creek Capital, LLC

Rod Washington: Rod is a blogger, writer, filmmaker, photographer, daydreamer who likes to cook. Rod produces and directs the web series, CUPIC: Diary of an Investigator. He also produces news and documentary video projects. Check out his podcast StoriesThisMoment at https://m3e.d71.myftpupload.com/stm-tncn-podcasts/